Worried about inflation? Here’s what you can do to put your mind at rest

Everybody’s talking about inflation

Whether it’s rising energy bills, or the price of a packet of biscuits, inflation is a hot topic – and it has been for the last few months.

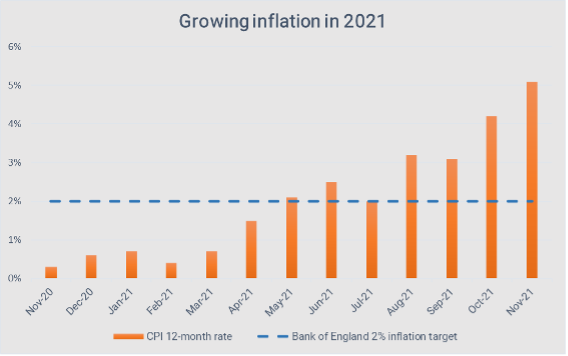

In November, the consumer price index (CPI) rose to 5.1%, its highest level since 2011. Meanwhile, the retail price index (another way of measuring inflation), is also at its highest in more than 30 years.

What’s behind the latest rises? Delays in the global supply chain, labour-force shortages, and rapid demand for oil and gas are all contributing to the cost of living going up.

And we’re seeing the impact all over. In food and drink, McVities, which makes HobNobs, Penguins and Jaffa Cakes, says pricing are going up as much as 5%. The hospitality sector has also warned of ‘terrifying’ price rises. Energy and clothing, meanwhile, are also hard hit.

Now, a little inflation is a good thing

Without it, there’s nothing to drive the economy forward. But there’s a difference between the levels of 2–3% we’ve become accustomed to and the recent rises. Too much inflation means the economy is potentially in serious trouble. To combat this, the Bank of England has already started to put interest rates up, its first rise since 2018.

Source: Office for National Statistics, consumer price inflation tables

How does inflation affect you?

At low levels, inflation can go somewhat unnoticed, but the impact month to month of rises of 5% and above are really hard to avoid – we’re all using fuel and gas this winter.

However, it’s important to remember, this is not likely to last.

Even with the current uncertainty over the pandemic, the continued problems in the global supply chain, and soaring energy prices, many economists still view this period as temporary (even if we’re not returning to the rock-bottom levels at the start of the year).

What can you do to protect the value of your capital?

The conversation about inflation is a timely reminder of one of the key advantages of investing.

Even at lower levels, inflation erodes the value of your money – unless you’re looking after it.

Look at the simple example in the chart below. If you start with £1,000, over 10 years it’s going to be worth less due to inflation. If the current levels of 5% lasted a decade, your cash would have nearly halved in value. But even with 2% inflation, you’ve lost nearly £200 in value. This means if you’re looking towards the long term, you need to look at solutions that can give you higher returns than the low interest rates of a bank or building society.

Being invested in real assets, as opposed to cash, can help you avoid this gradual erosion of value. Looking to the stock market, for example, can enable you to counter the impact of inflation on the pound in your pocket.

All investing comes with risk, so the best thing to do in any financial plan is find a balance. In the short term, it’s definitely advisable to have money that’s readily accessible – for that known expenditure or in an emergency. For the longer term, investments such as equities can protect your capital as you save towards your long-term goals. A financial adviser will help steer you through some of the trickier decisions.

How are we thinking about inflation at Better World Financial Planning?

Our portfolios have fared well in 2020 and 2021, with periods of strong performance outweighing the weaker months. Looking ahead to the next 12 months and inflation will be one of the key elements we consider as we carry out our regular annual review of your portfolio.

We’ll look afresh at your objectives, appetite for risk, and how portfolio performance has measured against expectations. We’ll also speak to you about anything that may have changed in terms of your goals and aspirations, to ensure your investments are still fit for the long term.

Get in touch to find out more about how we factor inflation into our decisions, or for anything else on your portfolio review.